Otherwise, expect Notice CP504, the last one before the IRS begins to take action to levy your accounts. If you don’t respond, you’ll get Notice CP501, marking the start of the IRS seizure process.ĭennis recommends calling the agency immediately to set up a payment plan if you can’t pay the money all at once. Responding on time won’t reduce your tax liability or the interest accrued since the filing deadline, but it may eliminate penalties. “This is your first warning that the IRS is looking for money,” notes Karla Dennis, an enrolled agent and principal of Karla Dennis and Associates, a tax and accounting firm based in La Palma, Calif. To avoid it, pay roughly what you paid last year split into four payments, says Patrick Astre, founder of Astre Planning, a tax and financial planning firm in Shoreham, N.Y.īalance-due notices. If you receive Notice CP14, the IRS is claiming that you underpaid your tax bill. One common audit trigger is underpayment of quarterly estimated taxes by those who are self-employed. You can find someone to help you through the American Institute of CPAs or an enrolled agent at the National Association of Enrolled Agents.

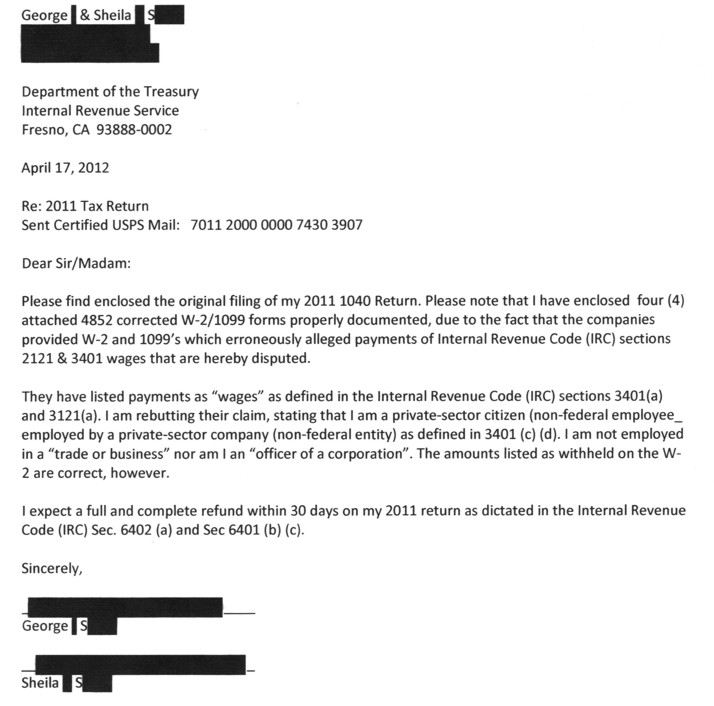

#LETTER FROM IRSS STATING I DIDNT NEED TO FILE PROFESSIONAL#

Respond to the IRS within 30 days or you’ll lose the deduction.Īudit request. If you do get an audit request notice, take it to your tax preparer or find a qualified certified public accountant or enrolled agent, a professional authorized by the IRS to prepare tax returns and represent taxpayers at all levels. For example, if your business mileage is questioned, send pages from a mileage log that you kept to support your claim. If you find that you made a mistake, send the signed notice back with your check.Ĭorrespondence audits. If the IRS sees a red flag on your return-say, a questionable business deduction or big increase in charitable donations over last year-it will request detailed backup information. To correct those errors, write a letter explaining the discrepancy and attach the evidence, such as W-2s, canceled checks for estimated payments, and bank and brokerage statements. If your claimed estimated tax payments differ from the amount the IRS received, expect to get Notice CP23, which indicates a tax discrepancy and balance due.

But the IRS sees only the brokerage’s record of sale and assumes the entire amount is taxable until you prove otherwise. If you sold stocks at a loss, you may have assumed that you didn’t have to report the transaction because you didn’t profit. If the interest reported on your 1040 differs from what your bank or brokerage reported, you’ll get Notice CP2000 outlining the discrepancy. It requires no action on your part unless you disagree with the amount. Notice CP49 tells you when the IRS applies any overpaid taxes to other taxes you owe. Here are some of them, in order of severity: The IRS hosts a page that explains the notices or letters taxpayers might receive. If the notice mentions name misspellings or wrong Social Security numbers, check your return and call the IRS with the proper information. Include photocopies of any evidence you need to provide. Respond within the prescribed period-usually 30 days-and put your answer in writing.

Let your tax preparer know about all but minor issues. If an IRS missive lands in your mailbox, open it quickly. You’ve filed your taxes, and though the chance of being audited is slim, you still could get a letter from the IRS.

0 kommentar(er)

0 kommentar(er)